Rothschild Report (2015)

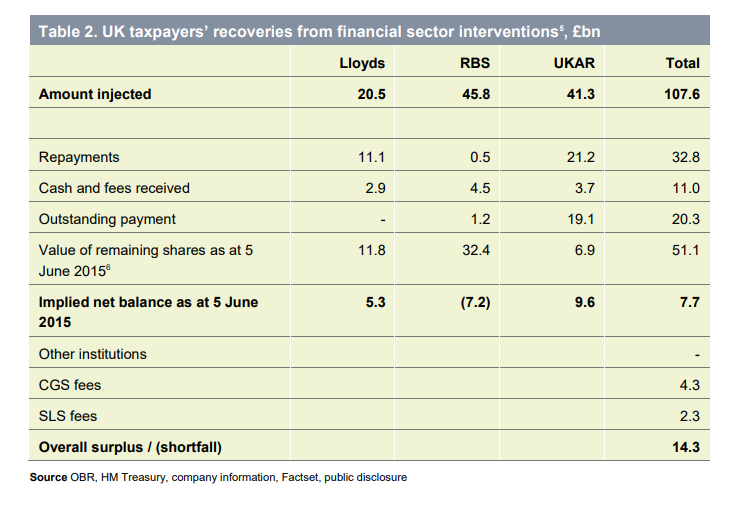

The UK government commissioned an independent report from financial advisers Rothschild on the eventual cost of the bank bailouts.

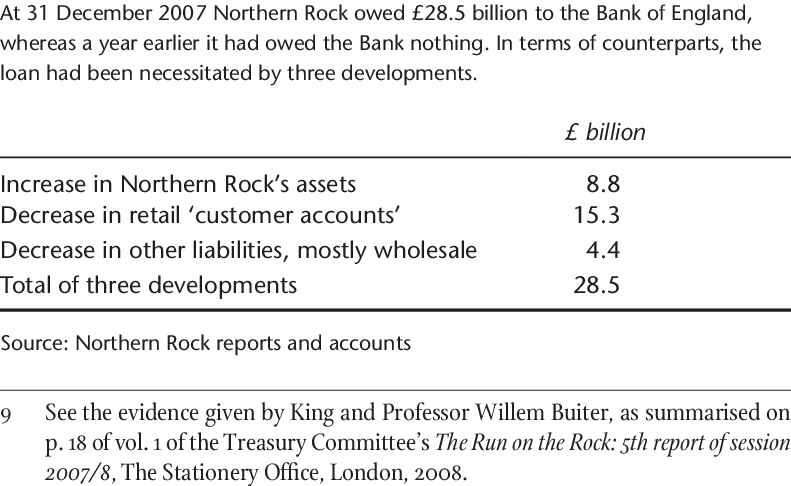

The results from this report are summarised in this table, which shows a huge surplus of £9.6 billion from UK Asset Resolution. UKAR includes Bradford & Bingley assets, but our view is that the positive net balance is due to the quality of assets in Northern Rock.

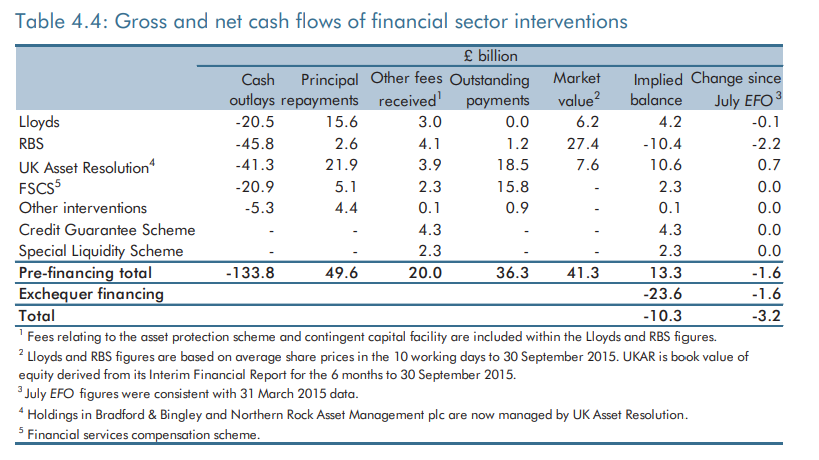

OBR Report (2015)

The Office for Budget Responsibility published a report at a similar time to the Rothschild Report, which showed the taxpayer would realise an overall cash surplus of £13.3 billion from all bank interventions.

The report showed a cash surplus of £10.6 billion from the holdings in Bradford & Bingley and Northern Rock Asset Management plc. Interestingly, this figure is similar to the implied loss from RBS of £10.4 billion. The Government ensured RBS shareholders retained interest in the bank whereas NR shareholders were completely wiped out. This is a classic example of "Robbing Peter to pay Paul."

The OBR made overall deductions of £23.6 billion for Exchequer financing, which is believed to be a debt interest cost. We're unsure why this figure was deducted as its profit. The Rothschild report also accounted for debt interest.

NR paid HMG loans back at a penal rate of interest.

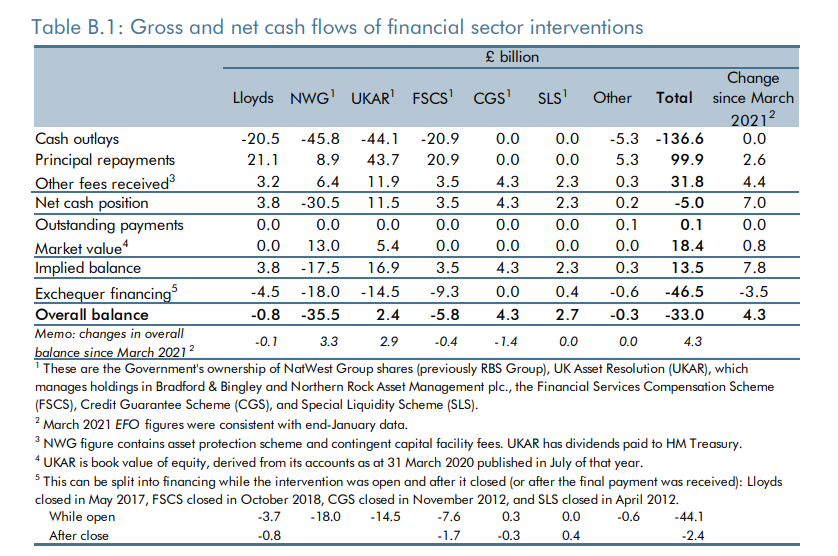

OBR Report (2021)

The OBR showed a cash surplus of £16.9 billion from the holdings in Bradford & Bingley and Northern Rock Asset Management plc in a report published in 2021.

Again, the OBR made overall deductions for exchequer financing, this time a deduction of £14.5 billion was applied to UKAR.

We're unsure why this figure was deducted as its profit. The Rothschild report also accounted for debt interest.