Key

Government statements of NR Value: -

• November 2007, Prospectus for sale stated Goldman Sachs supported £2.8 Billion - £3 Billion NBV over up to three years.

• February 2008, NR is placed in a state of ‘temporary’ nationalisation. The Chancellor, Alistair Darling, stated that the Government would inject £3.3 Billion of Capital into NR but only £1.4 Billion was injected.

• 2012, the UKFI estimated that Government would achieve a net gain up to £11 billion over a period of up to 15 years.

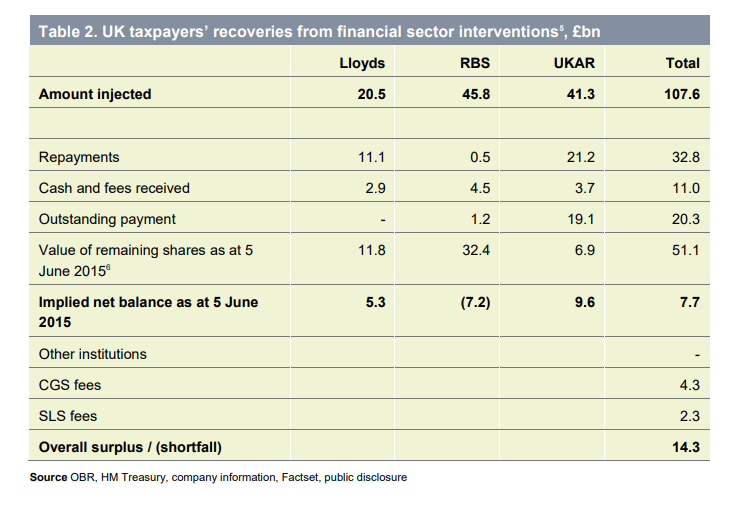

• 10 June 2015, the Chancellor, George Osborne, stated ‘that the Government would secure a Net Surplus of £9.6 Billion from NR/ Bradford & Bingley, based on Rothschild/Treasury Estimates’.

• 2020, a letter from Steve Barclay HM Treasury Minister to the NR Action Committee stated that any ‘surplus’ from NR would be used to cover losses on the Royal Bank of Scotland. The Minister neither accepted nor rejected our assertion of a (cumulative) £9 Billion Net Value – How can a surplus from NR be morally justified to support other banks?

• 2015 and 2021 estimates from the OBR (established by HM Treasury) gave a valuation of £10.6 and 16.9 billion respectively**.

** Both valuations relate to UKAR – the combined total of Bradford & Bingley and NR