Northern Rock Shareholder Profiles

Brokers (shares held on behalf of retail investors) and Institutions held about 75% of Northern Rock shares with the rest directly held by private individuals. Below are some typical profiles of individual shareholders.

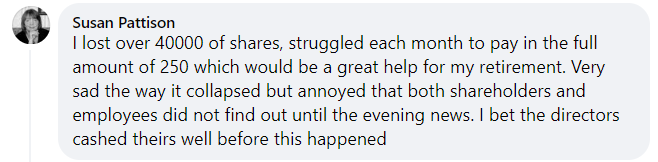

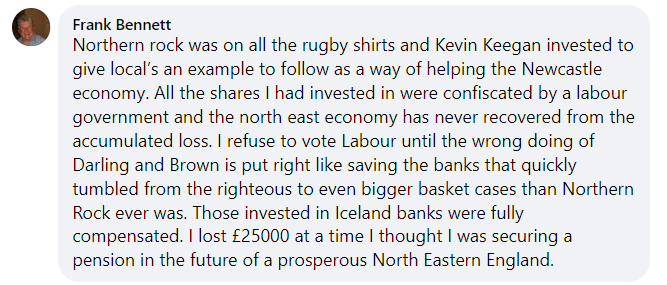

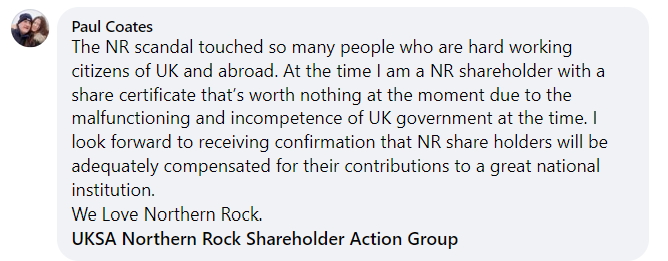

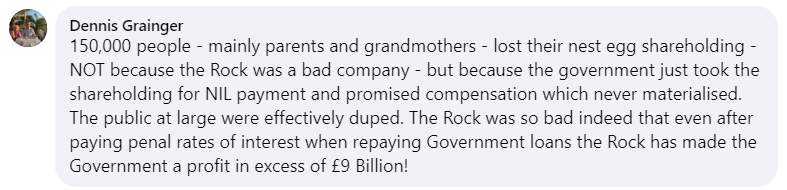

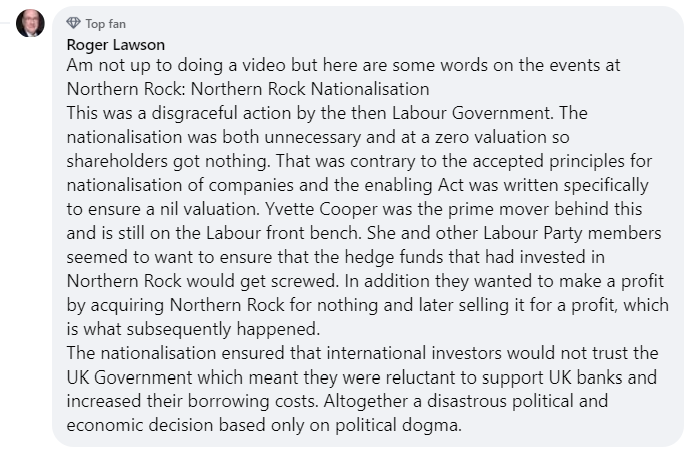

It was suggested in the press that the only people left holding Northern Rock shares at the date of nationalisation were short term speculators. This is not true and does not represent the profile of the shareholder base at all. Shareholders in Northern Rock at that date came from many backgrounds but all of them were continuing to hold the shares because they had faith that in essence it was a sound company that could easily recover from its temporary difficulties, and they considered the market price to be below the fair value of the assets.

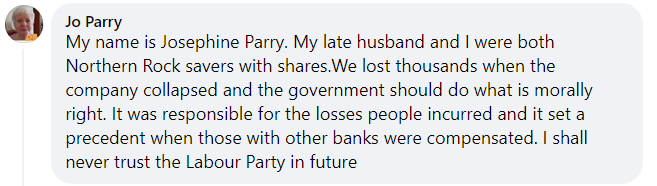

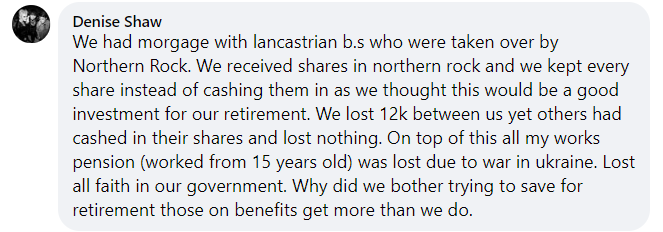

Private shareholders in Northern Rock can be grouped into the following main categories:

Those who had held the shares since the company was demutualised ten years prior to nationalisation. There were 120,000 shareholders on the register with typically 500 shares each some months before nationalisation and the vast majority did not panic and sell their shares in the run up to nationalisation.

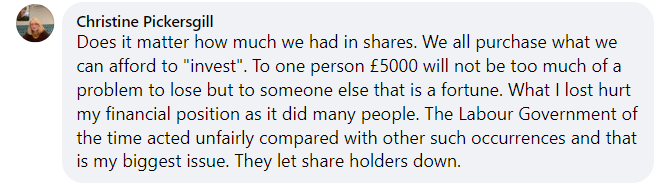

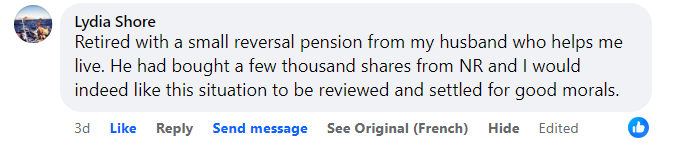

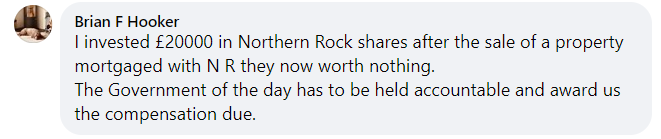

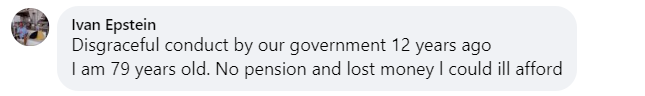

Investors who had purchased shares in the last ten years prior to nationalisation, based on it being a sound investment for the future because banks traditionally safe investments offering a high dividend yield, often these were people in retirement looking for income.

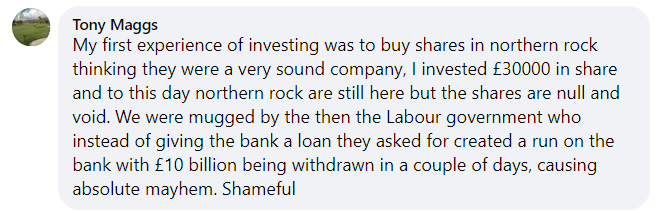

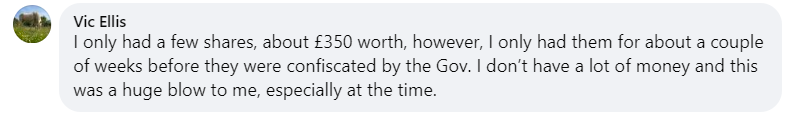

Shareholders who purchased the shares in the last few months prior to nationalisation or weeks before nationalisation as a long term investment primarily based on the share price undervaluing the business.

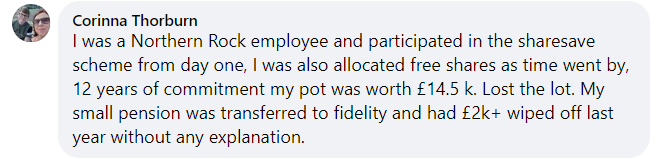

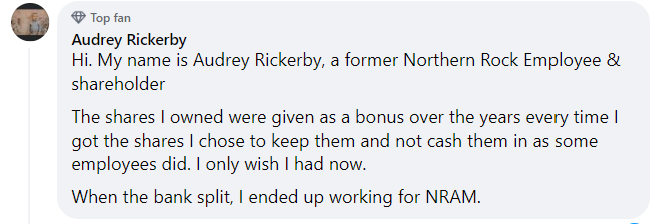

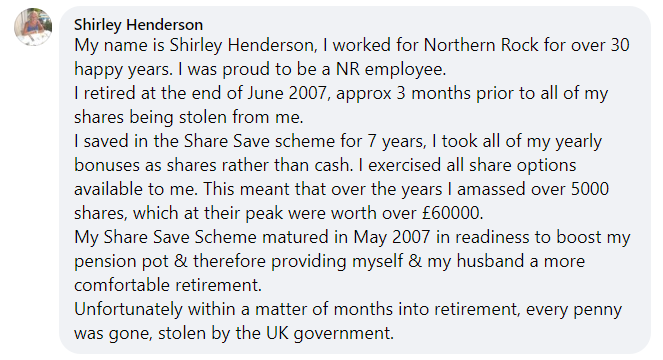

Shareholders who acquired their shares as employees of the company under share option and share save schemes. They contributed a portion of their monthly salary towards these schemes.

Robert Bacon

Robert acquired 500 shares in the original demutualisation but bought more in September 2007 as a long term investment as he considered the shares undervalued at that time. The later shares were acquired at 310p, 260p and 239p, just before news of the support from the Bank of England leaked out. He is particularly unhappy about the Government compensation process.

Alun Melson

Alan also acquired his shares in the original demutualisation. He regarded the shares as a nest egg and as a supplement to his small income. Alun used to be a nurse but he has had to retire early on health grounds. He considers the Government acted despicably in regards to Northern Rock and have rigged the compensation process at the expense of former shareholders.

Ian Stroud

Ian purchased over 1000 shares in September 2007 on the basis that it was an investment. He is a retired Merchant Marine Captain who lives in Norfolk. He invested when the Government had guaranteed the deposits held at the bank, but considered the independent valuer being asked to perform a "rip-off" on behalf of the Government as Northern Rock has always been a "going concern".

Patricia Townend

Patricia purchased shares in early September 2007 at a price of £7.43 and she feels that there was a false market at that time because the company, the FSA and the Bank of England knew the company was in difficulties but had not publicly disclosed this information for several weeks. If she had been privy to this information she would never had bought the shares.

Hugh Wynne

Dr Wynne acquired his shares in the demutualisation. He recently retired and he considered the income from the shares as a useful supplement to his pension. He feels the Government handled the whole situation very poorly and has attempted to skew the compensation process.

Ann & Robert Wallace

Ann and Robert acquired their shares in the demutualisation. They were both mortgage holders and savers with the Northern Rock bank and regarded their shares as a nest egg and to be kept in case of a "rainy day". They feel the Government is totally responsible for their plight with the FSA failing to protect people like them and the Government not accepting responsibility for its failings.