Rothschild Report (2015)

Shows surplus of £9.6 billion from UK Asset Resolution, which includes Northern Rock and Bradford & Bingley.

Northern Rock was a community bank based in Newcastle with many local shareholders and employees who also chose to invest in their bank. Some lost their life savings. NR had 180,000 shareholders, the majority individual, and 16 years after the appropriation many of their family members have grown up into adulthood. Conservatively that means around half a million adults have a reason to be offended by the continuous refusal by government to compensate for the unfair appropriation of NR shares, in contrast to the favourable treatment of the effectively-bankrupt London banks.

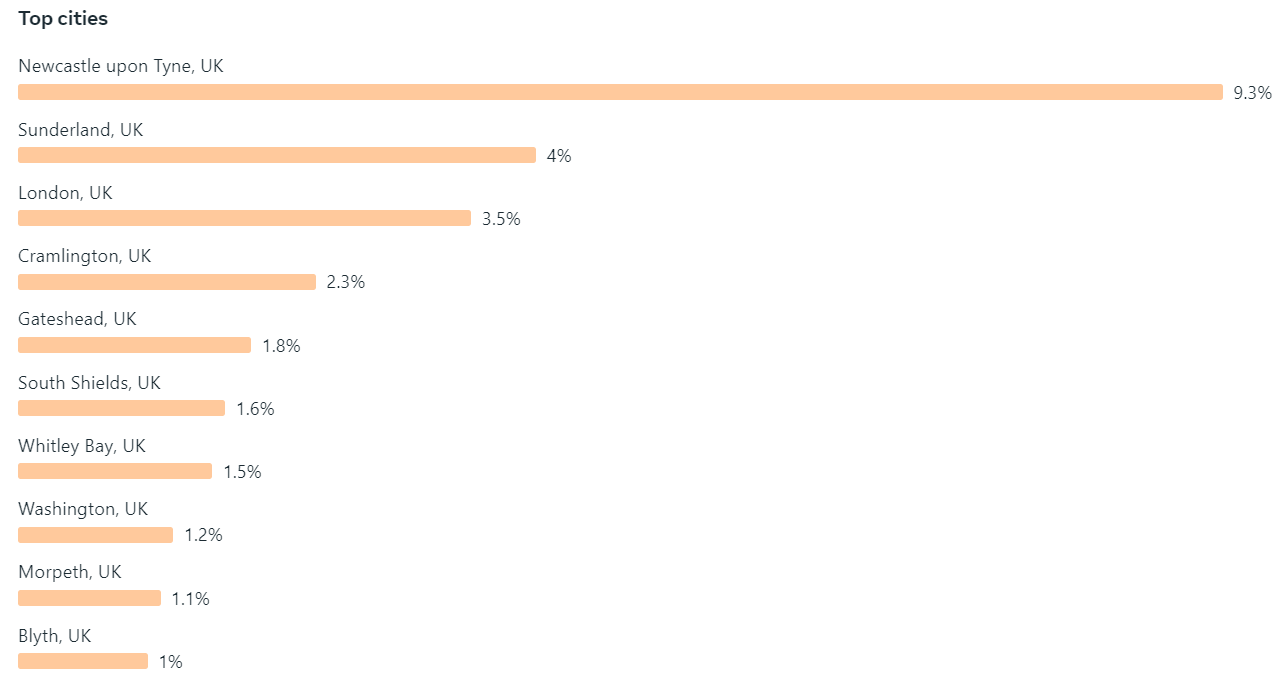

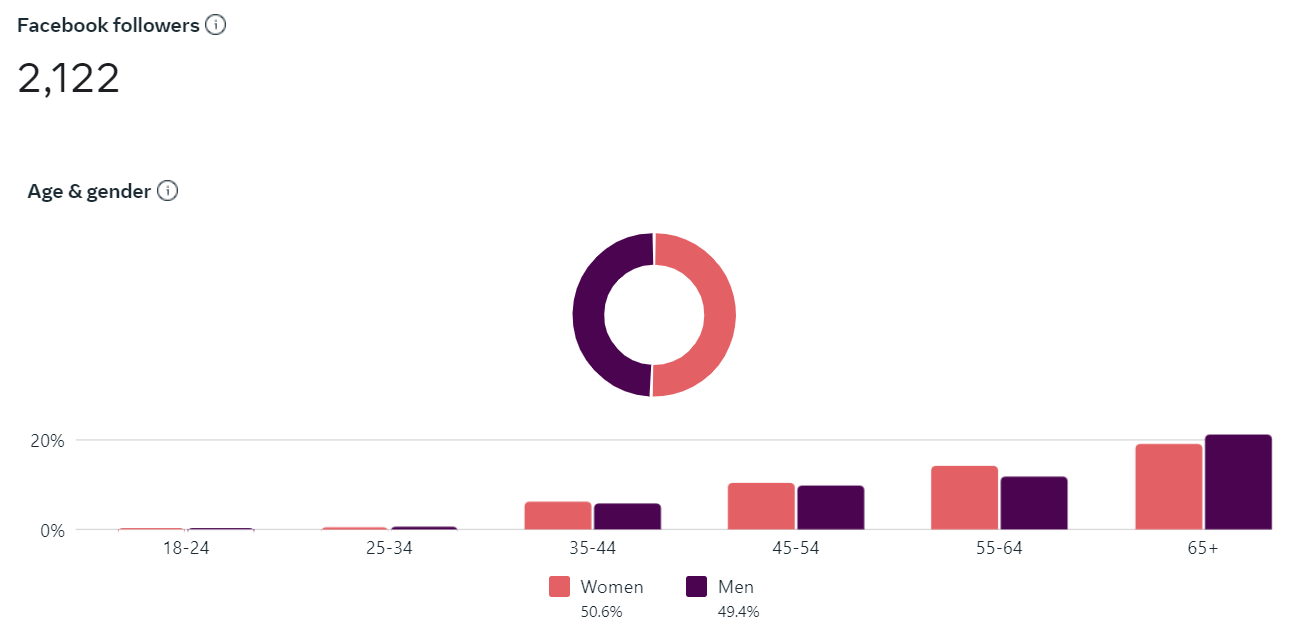

We estimate that around 150,000 former shareholders are still alive. Our Facebook following shows the Top-10 cities our group members reside in. If we forecast in a similar fashion to the way election polls are conducted, the graph indicates there could be around 14,000 former shareholders from the Newcastle area, around 6,000 from Sunderland, around 5,250 from London, around 3,450 from Cramlington, around 2,700 from Gateshead, around 3,600 from Cramlington, around 2,400 from South Shields, around 2,250 from Whittle Bay, etc. The illustration also shows that former shareholders are mostly elderly.

Shows surplus of £9.6 billion from UK Asset Resolution, which includes Northern Rock and Bradford & Bingley.

The report showed a cash surplus of £10.6 billion from the holdings in Bradford & Bingley and Northern Rock Asset Management plc.

The OBR showed a cash surplus of £16.9 billion from the holdings in Bradford & Bingley and Northern Rock Asset Management plc in a report published in 2021.